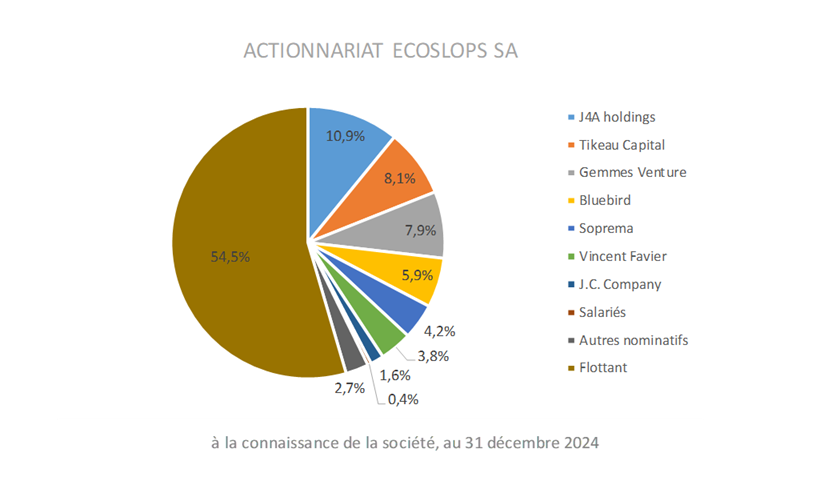

Would you like to support the energy transition and avoid pollution from hydrocarbons and used lube oil?

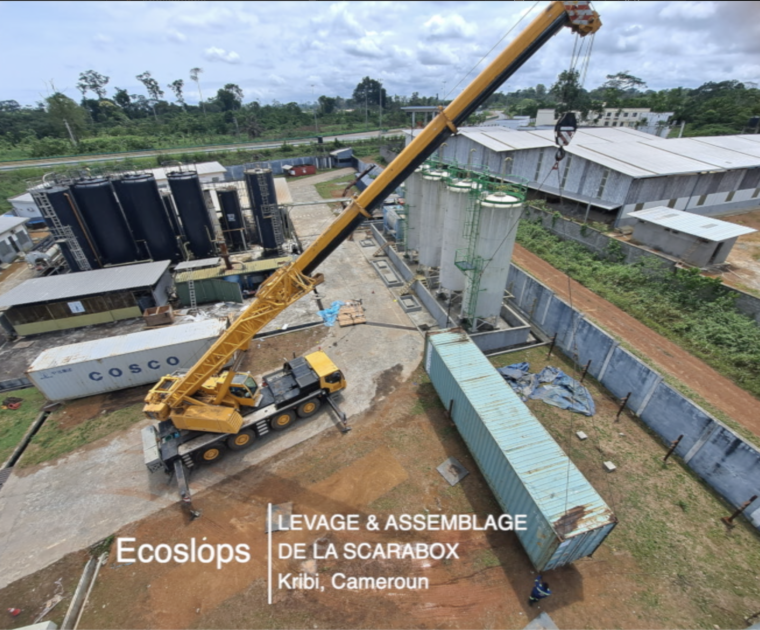

You can help Ecoslops spread its innovative knowledge more quickly and contribute to the circular economy of oil residues around the world.

- Global development potential

- Unique to the world expertise

- Energy produced with a reduced environmental footprint

- A company invested in Sustainable Development